Maximizing Profitability and Minimizing Risk: An Industry Analysis of Policy Sales in the Insurance Industry

Project Question: Which industry should the company sell more policies to, considering the risk (High-Value Equals More Risk)?

Executive Summary:

This case study is based on a 500-row transactional level dataset across 13 industries and four regional markets over 2021. The goal of the project is to provide guidance on improving the company's profitability while managing risk.

Analysis Details:

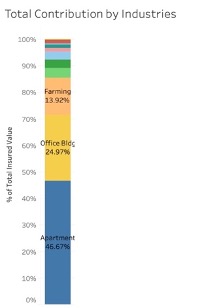

After conducting the analysis, I strongly recommend that the company primarily focus on selling policies to its primary customer groups, including the apartment, office building, and farming industries, as they contribute over 86% of the total revenue. However, if the company is willing to take on additional risk for the potential for higher profits, it could also consider promoting policies in the construction, manufacturing, and recreation industries. These industries have the potential for excess profits, with the construction industry offering the highest returns but also the greatest risk.

Although the overall trend line of performance appears to be slightly upward, I caution that this conclusion is limited due to the small size of the dataset. I recommend focusing on retaining primary customer groups while also promoting policies in the lower-risk, higher-return industries of recreation and manufacturing, especially during times of economic recession.

Conclusion:

To improve profitability and manage risk, I suggest the company focus on retaining its primary customer groups while also promoting policies in the recreation and manufacturing industries.

Limitations: The analysis is limited by the small size of the dataset and only considers one variable for evaluating risk and return. It may not be representative of more complex scenarios.

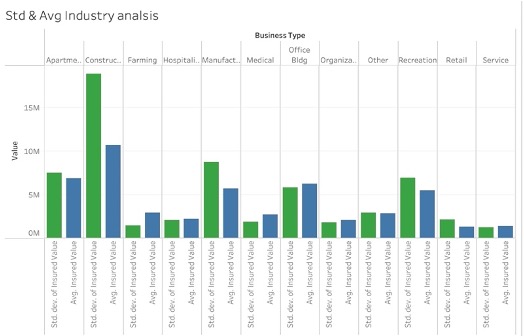

- The three industries with excess profits’ differences in its Standard Deviation and its Average are larger than other industries.

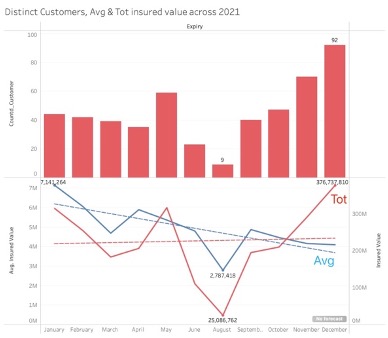

- This chart shows the distribution of customers and the trend of its average and total insured value over the year, excluding July 2021.

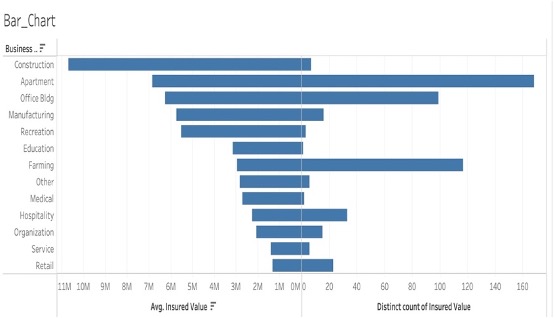

- Primary client groups are Apartment, Office Bldg and Farming industry

- Three Primary Client group contribute about 86% of the overall revenue

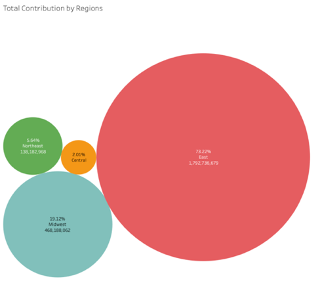

- Regional Market Share: East(72.32%), Midwest(19.12%), Northeast(5.64%) and Central(2.01%)