Mitigating Taxi scams through advanced data analysis: A case study in detecting third-party fraud transactions

Relevant reading:

Background:

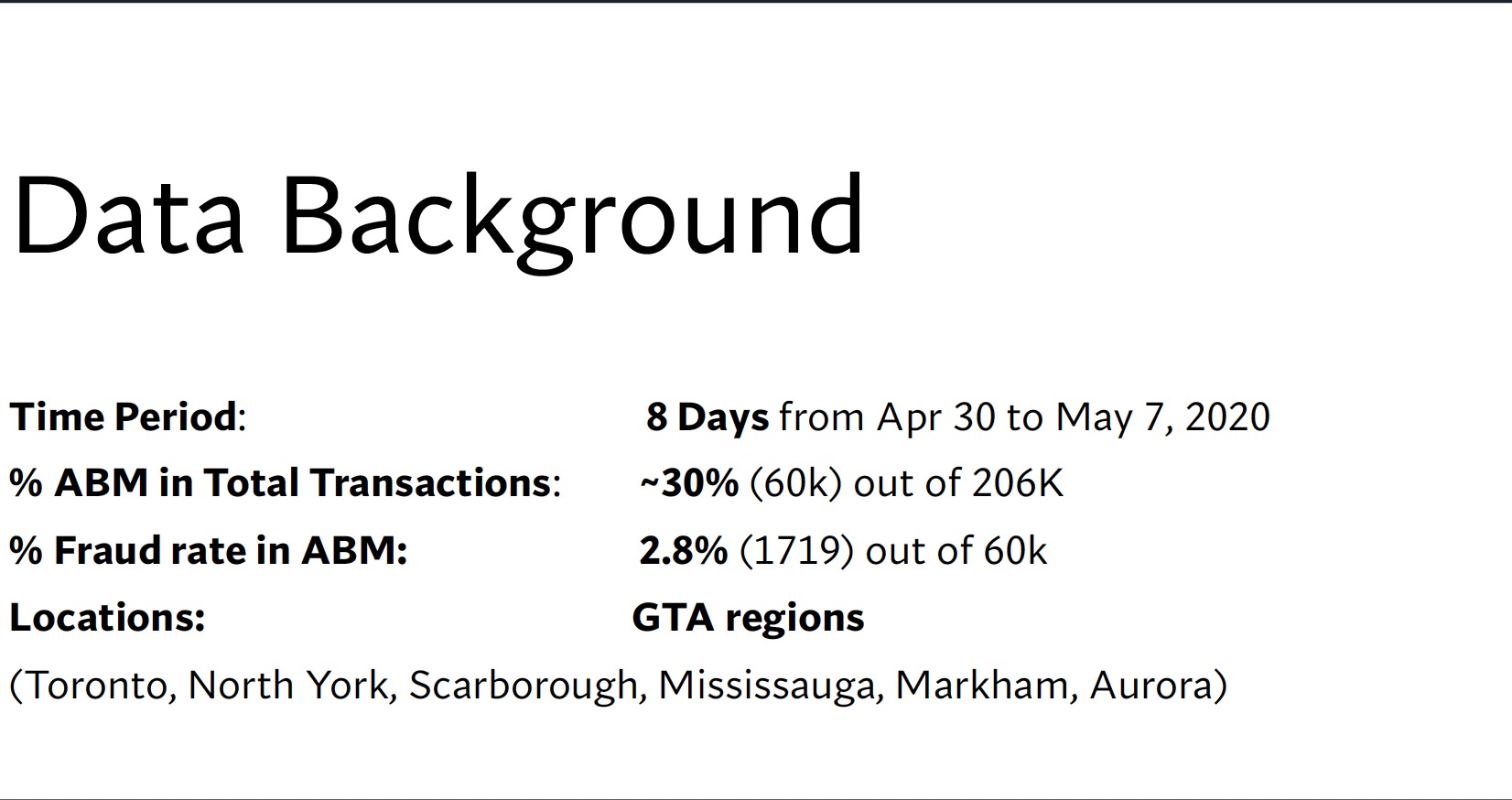

Taxi scams are a persistent issue in Toronto, often resulting from a lack of awareness on the part of cardholders when paying their bills. This case study outlines the steps taken to develop a rule for detecting taxi-related fraud transactions.

Objective:

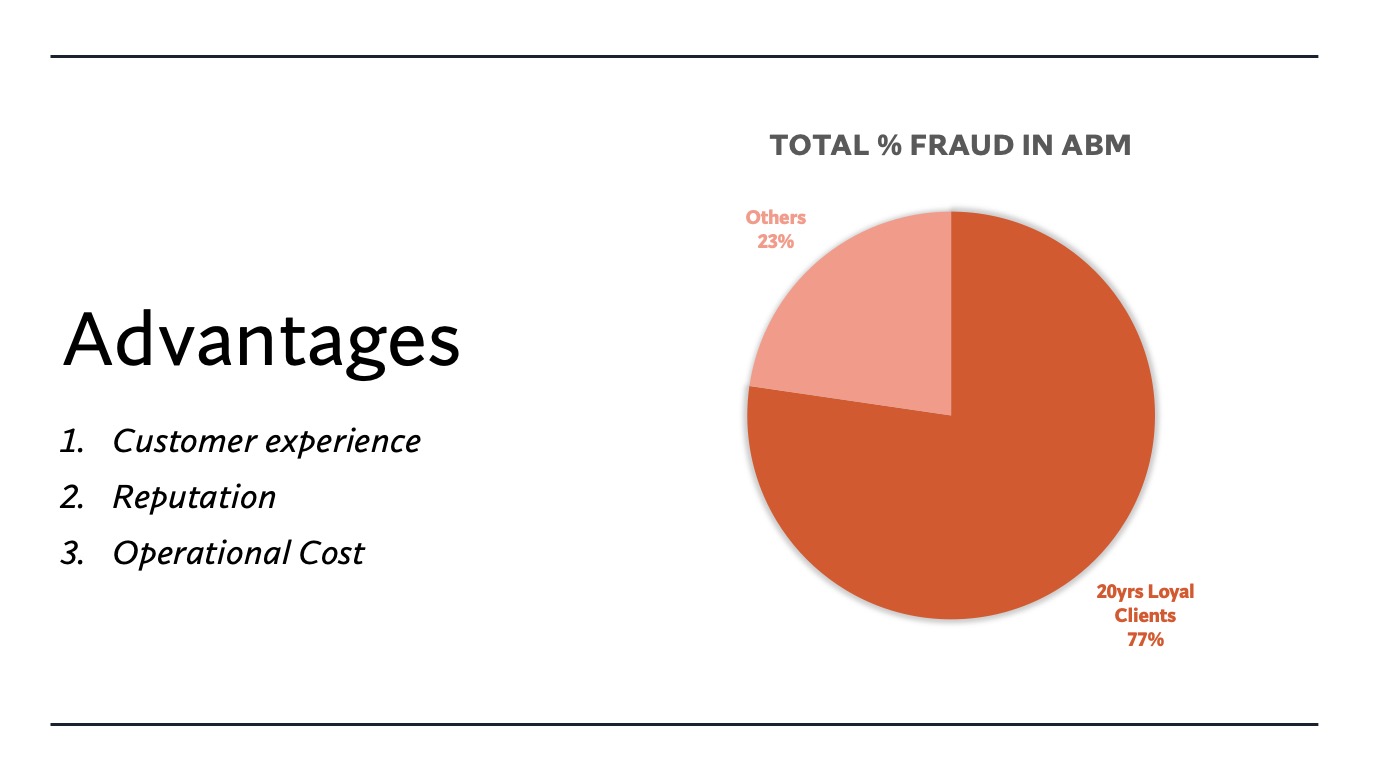

The objective was to create a rule to mitigate third-party fraud, specifically in regards to taxi scams. The benefits of this rule include improving the customer experience, enhancing the reputation of the bank, and reducing the bank's losses.

Actions:

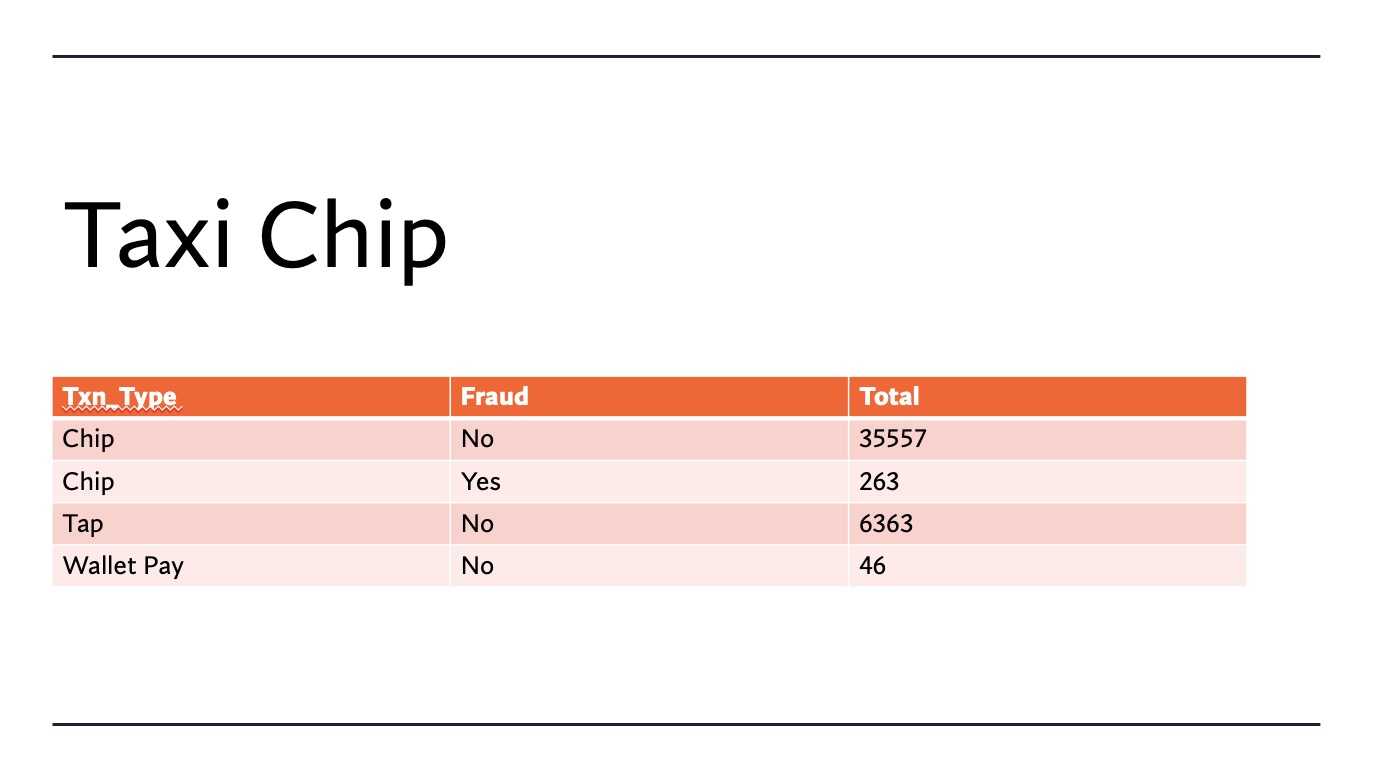

• Analyzed over 200,000 transactional level data through the use of data cleansing techniques in SQL.

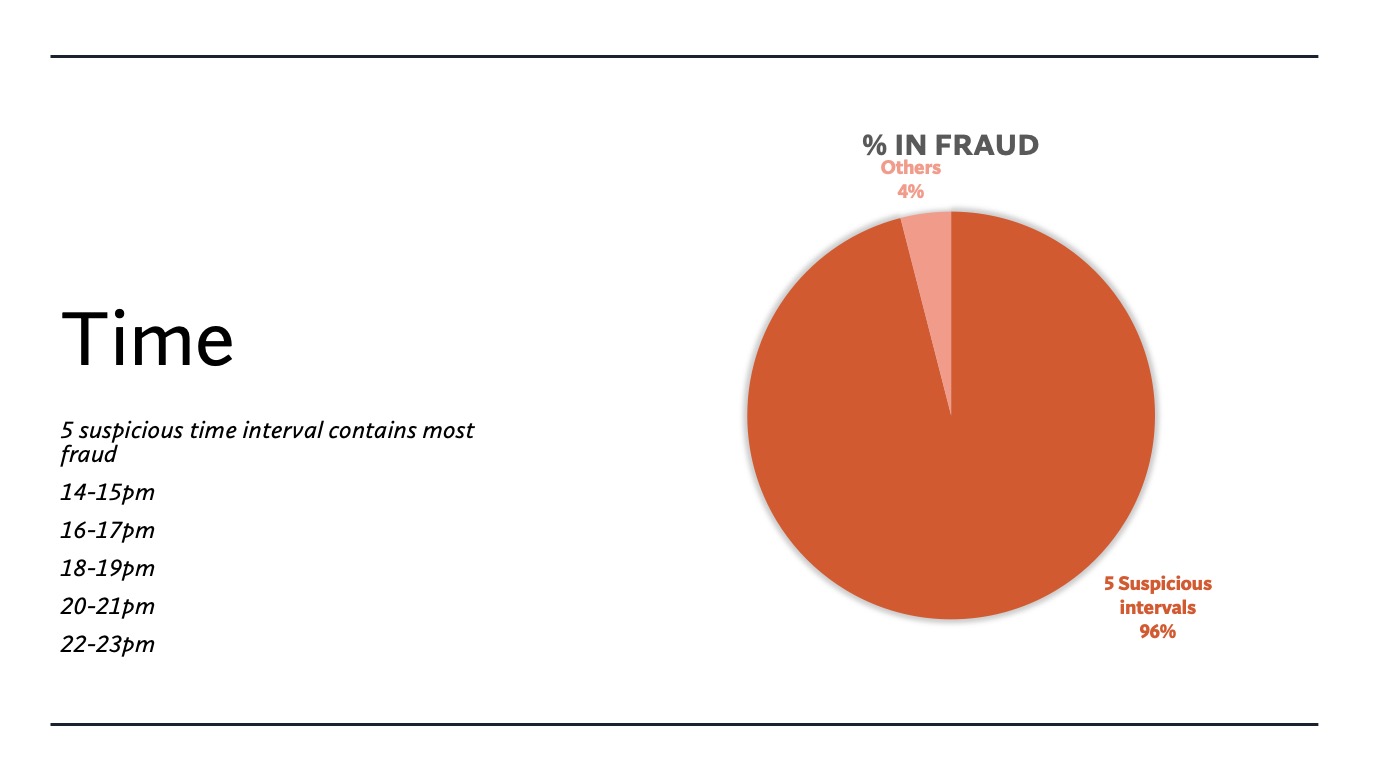

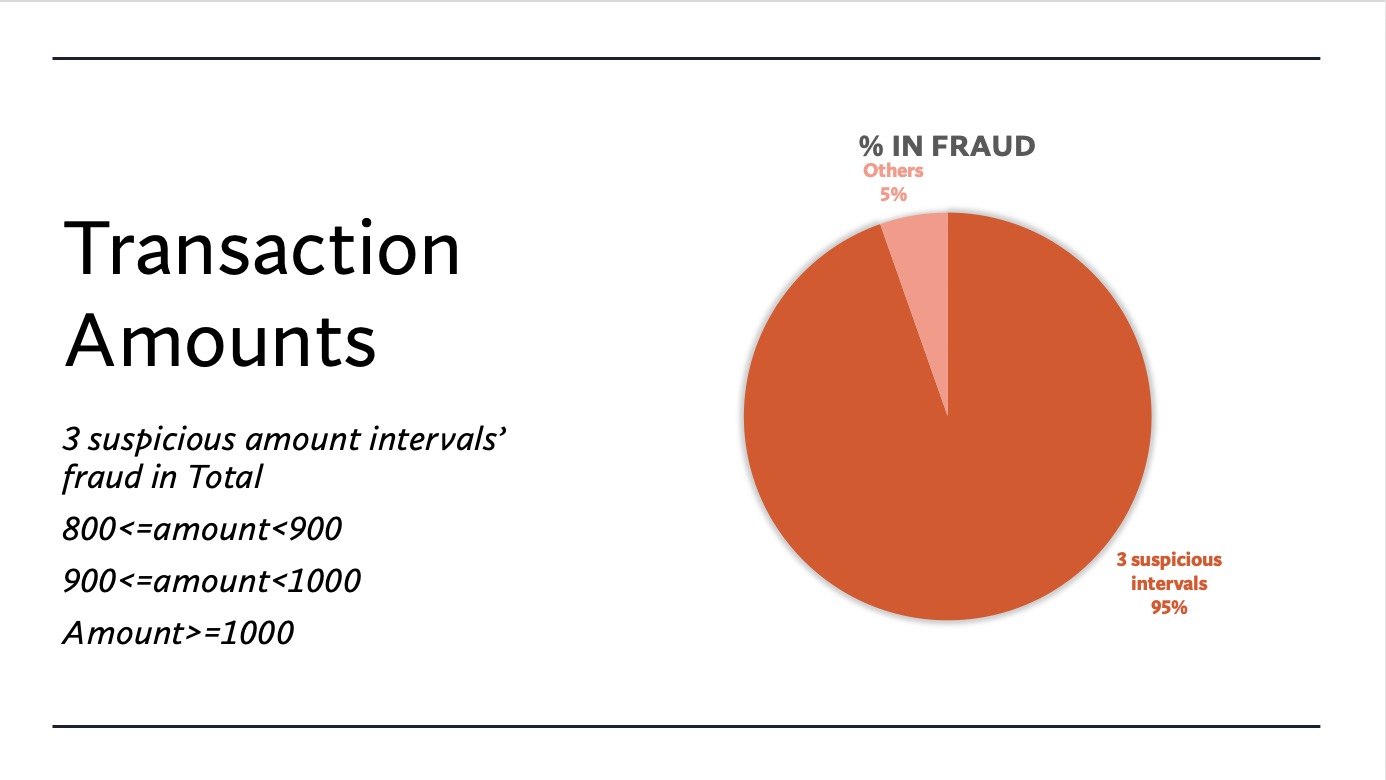

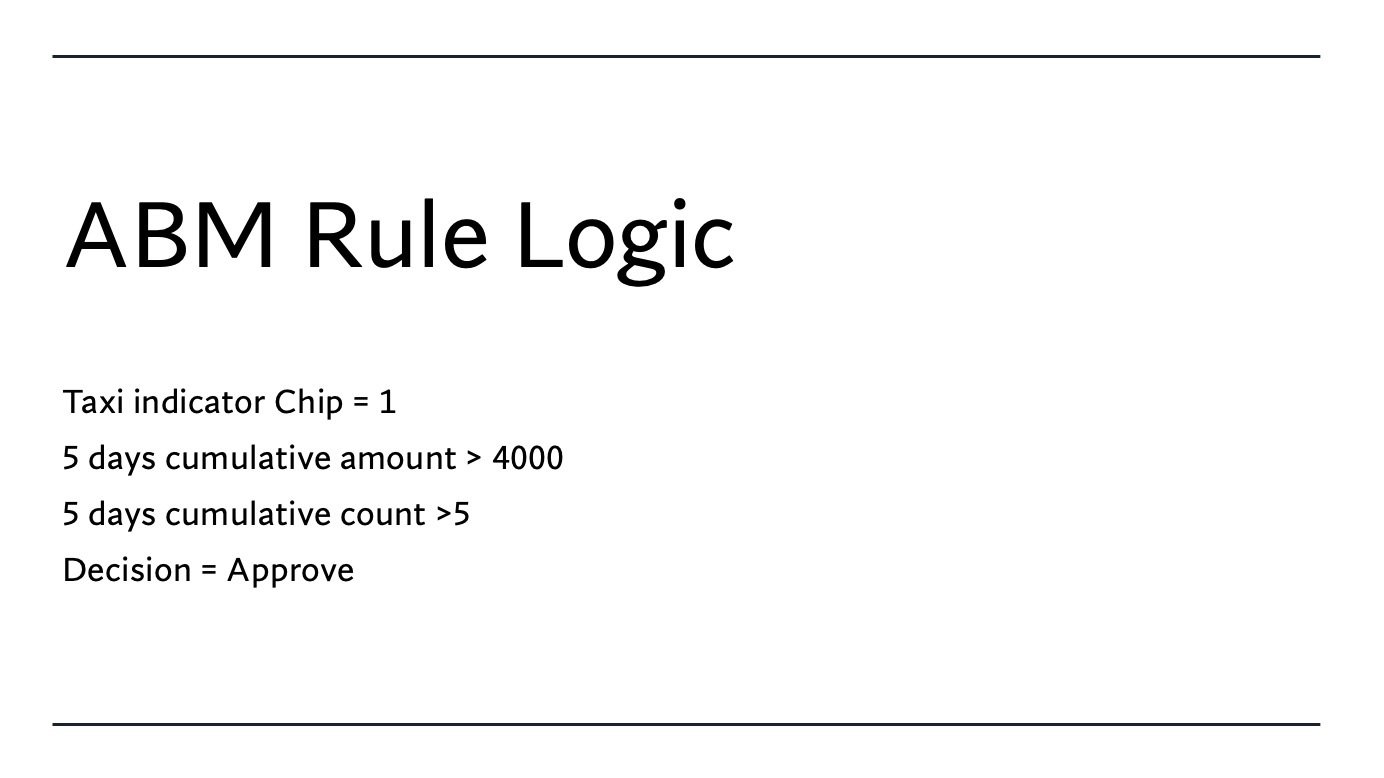

• Implemented feature engineering by utilizing self-joining and data manipulation methods to create a rolling time window summary.

• Conducted univariate analysis.

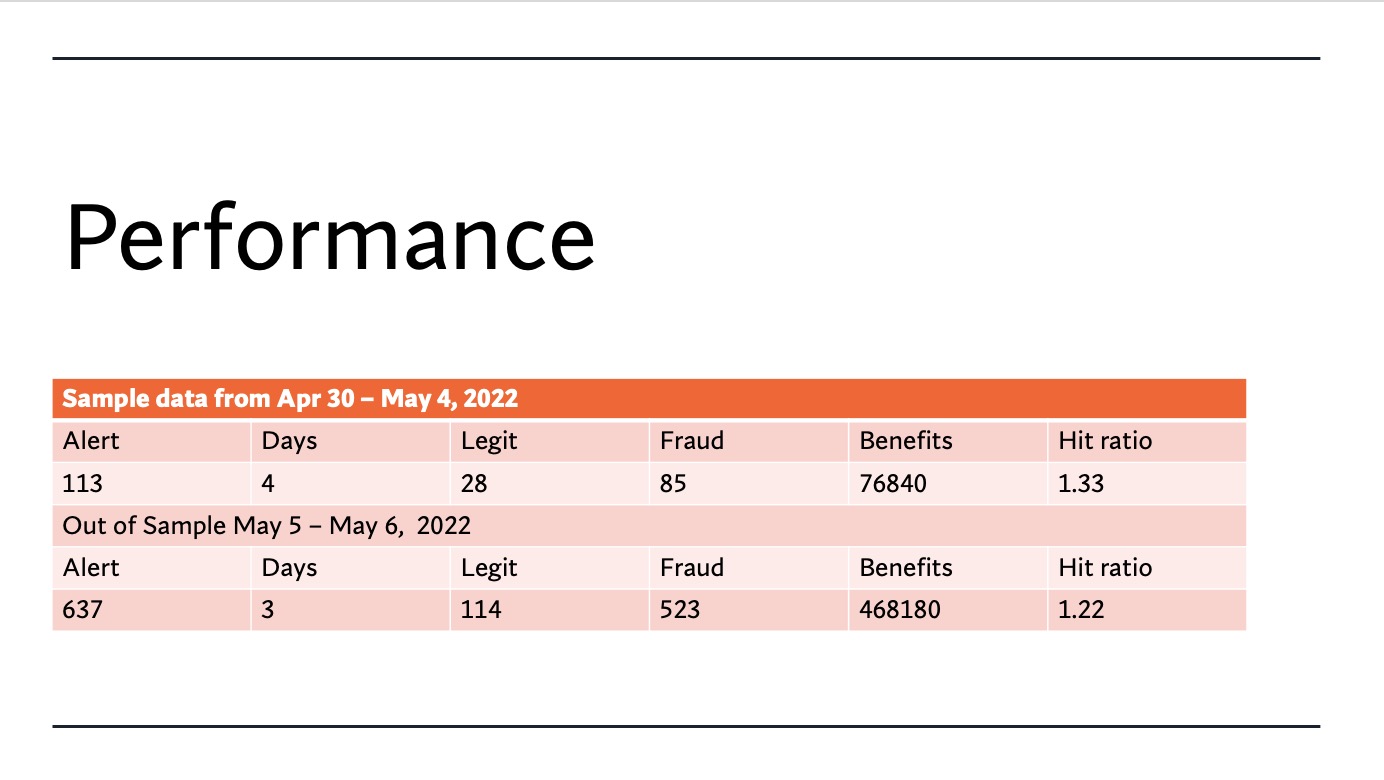

• Assessed the rule's performance through key metrics.

Results:

The rule performed well in both the testing and validation datasets. The hit ratios were 1.33 and 1.22, respectively, indicating that one fraud transaction could be detected for every 1.22 alerts generated. With hit ratios below the hit ratio benchmark(5 to 6), the rule can be effectively implemented in a real-time environment through the Proactive Risk Manager.