Improving Customer Retention and Maximizing Profitability in the E-commerce Industry: A Case Study of a Chinese Company

Project’s Questions:

How to improve customer retention and maximize profitability?

Executive analysis:

Background:

The case study was 400k+ transactional level data that an e-commerce company generated in China from February to April 2016. The objectives of this project are to identify high-value customers who purchase less with the most contribution and to develop marketing strategies to improve customer retention and optimize profitability. The K-means and the RFM model are the two methods I used to explore and analyze the data in Tableau.

The K-means model

- Here’s the Tableau Viz using the K-means method (interactive).

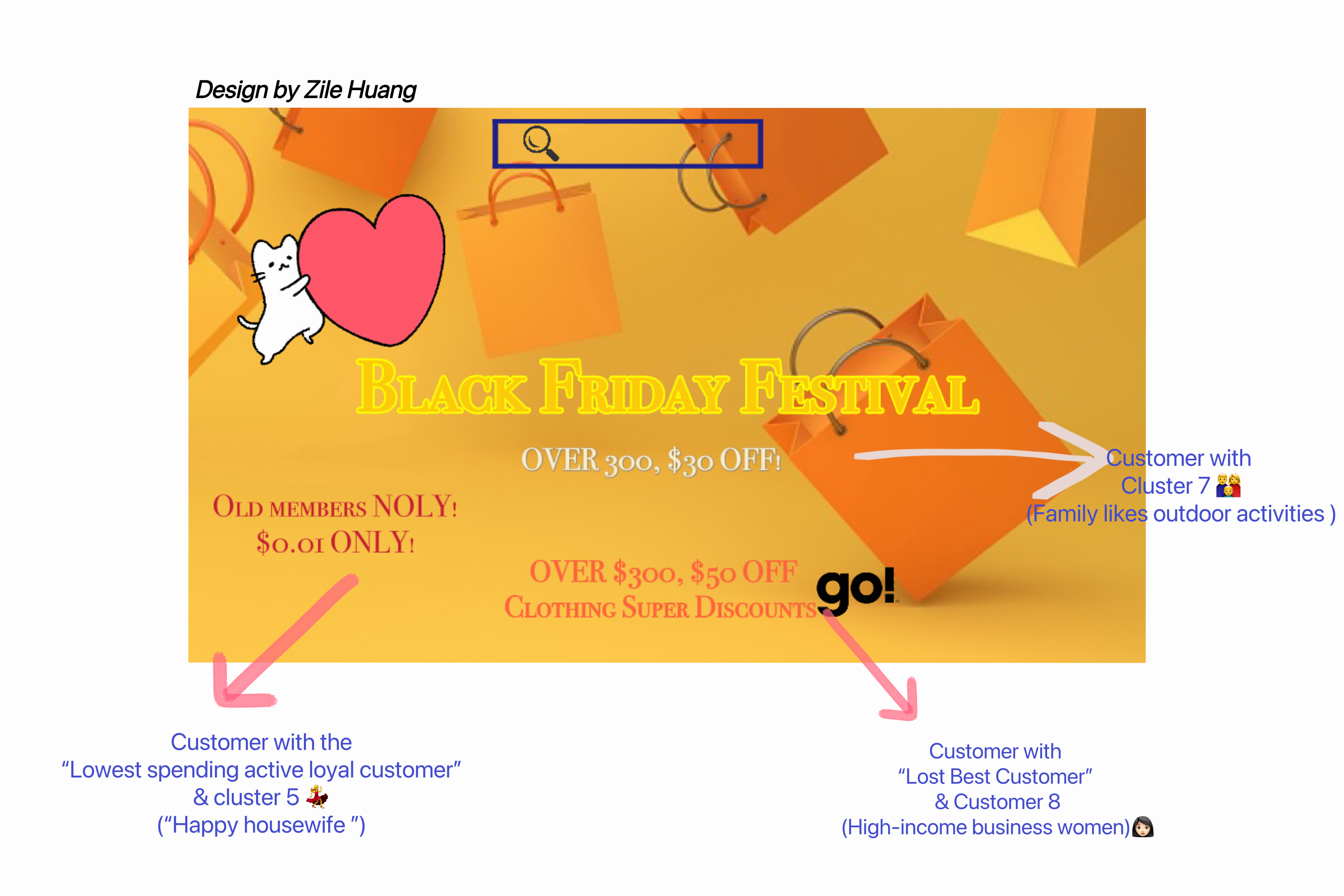

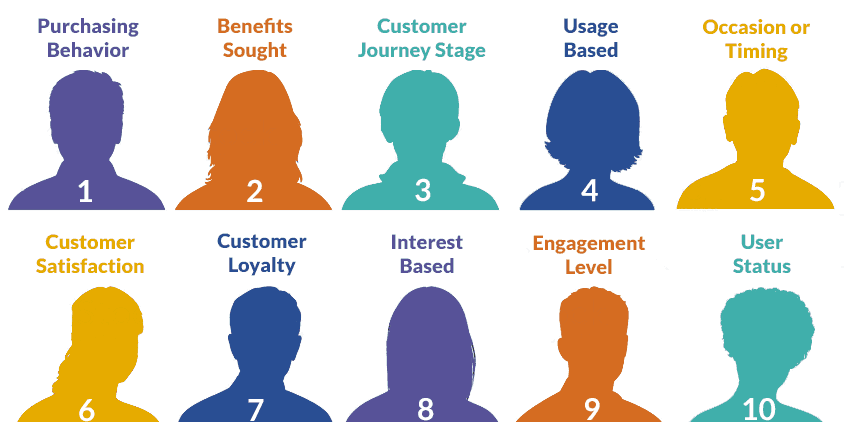

In this case, the data was separated into 10 cluster groups. Only four cluster groups can be interpreted further since several clusters have substantial similarities, and others have insufficient data, which is an obstacle to further interpretation.

- Elborw method helps to find the optimal numbers of clusters.

The RFM model

- Here’s the Tableau Viz using the RFM model method (interactive).

However, the RFM model can address the limitations of the K-means since the RFM model is detail-oriented, and can combine business knowledge. Those high-value customers, especially Lost best customers, are our target customer groups; therefore, using the RFM model to cluster data into five groups based on the RFM scores. The RFM scores consist of three digits: recency, frequency, and monetary. Each rating scale is from 1 to 5. 1 refers to the most, and 5 refers to the less.

Conclusion:

The K-means model has limitations when data quantity is limited. However, the RFM model does substantially help to cluster groups by customer behaviors. We can combine outputs from both cluster groups in the K-means and the RFM model for further business insights and design different marketing strategies to improve customer retention and maximize profitability.

- Click Here to learn more details about the project

- The poster below indicates how we applied the marketing strategies into its website.